SMS

SMS

Any

Any

Automation

& 2 more

Automation

& 2 more With the Covid-19 pandemic, the need for contactless systems has increased multifold. Even with the world getting back to normal, contactless systems continue to grow. This is because its advantages are beyond just the prevention of the spreading of viruses. Payments are an integral part of any person's day-to-day life, be it buying groceries or selling your business' product. The use of contactless systems in the payments world has increased multifold in recent years with the advent of `Unified Payments Interface` (UPI), the government's support for online systems, and the current Covid Pandemic.

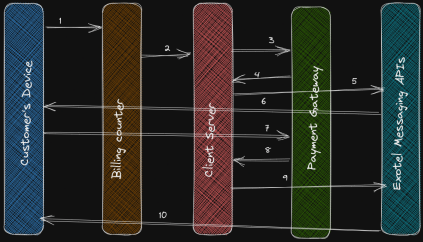

1 Customer provides the payment details to the billing counter.

2 Request goes from the billing counter to the client-server.

3,4 client-server sends the customer details and gets a link for the payment ● 5 Exotel gets a whatsapp request from the client server

6 Customer’s device receives the message with the payment details ● 7 Payment gateway receives the payment

8 Client-server receives the payment confirmation details

9 Client server sends the receipt via Exotel

10. Customer’s device receives the receipt.

Picture this - Pallavi walks into a store, picks up what she wants, and walks to the payments counter. On giving her phone number to the cashier, she receives a WhatsApp message with the items she had picked out and the total amount she owes. Pallavi clicks it and is redirected to a payment gateway. She quickly makes the payment using the payment method of her choice - UPI. If it’s an image, Whatsapp can automatically look for a QR code and recommend WhatsApp UPI payment.

Once that succeeds, she receives another WhatsApp message with another link. When she clicks this, she can see the invoice for her purchase. She picks up her items and walks out of the store like a boss.

Contributed By:

Arun Iyer

Kashish Raheja

Last modified Date

October 18th, 2022